5 Steps for CEOs and CFOs to Mitigate the Impact of Tariffs and Economic Uncertainty

During periods of economic volatility, business leaders must proactively identify and manage risks that can threaten profitability, liquidity, and long-term survival. Here are 5 proven steps to identify and evaluate business risks, assess their impact and likelihood, and develop actionable strategies to ensure financial and operational resilience.

Q1-25: M&A Activity Stalling Amid Market Uncertainty

M&A activity showed signs of recovery in late 2024, but market uncertainty in early 2025 has stalled deal momentum. Despite declining borrowing costs and a record $2.6 trillion in private equity dry powder, investor hesitation has grown due to unpredictable trade and economic policies. Companies considering a sale should focus on financial preparedness and operational efficiencies to position themselves for success when dealmaking accelerates.

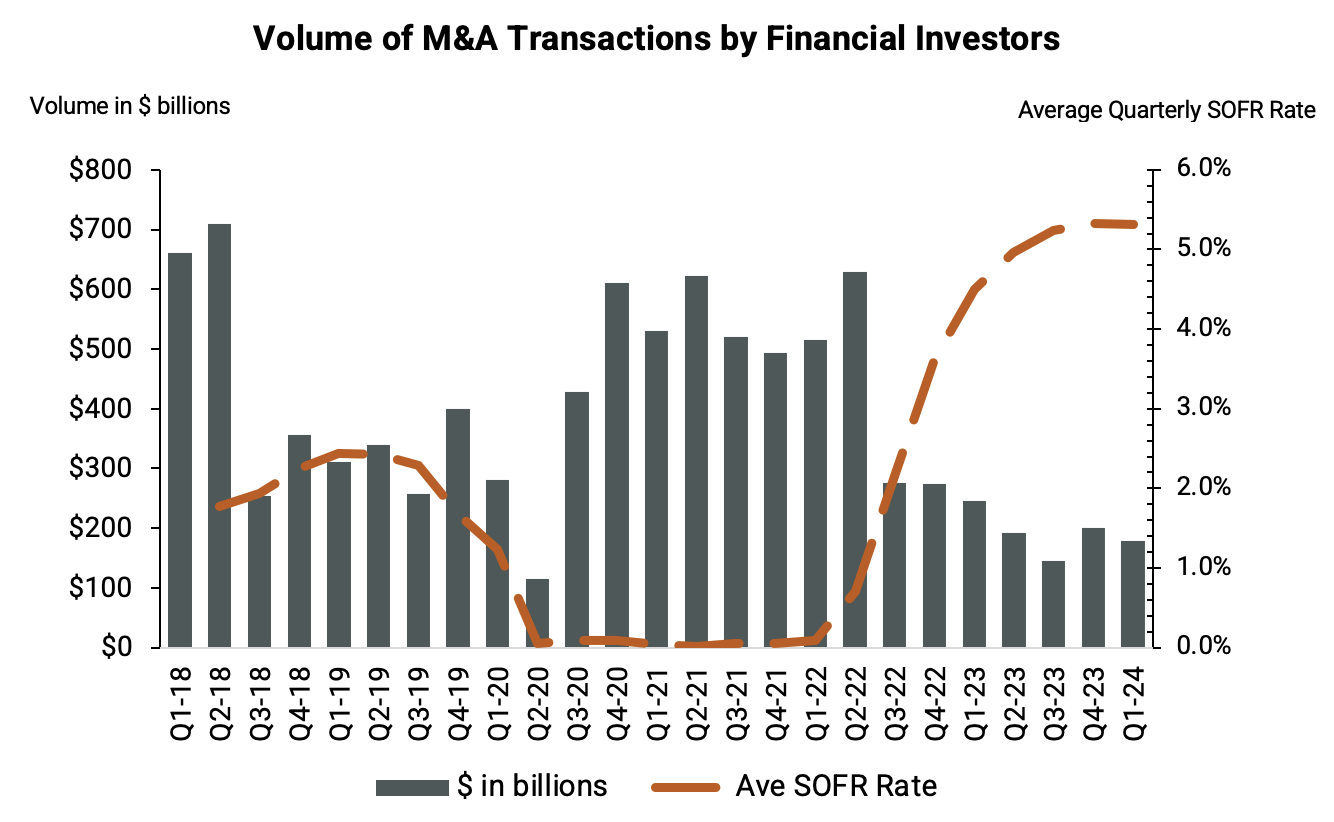

Q3-24: M&A Activity by Financial Investors Remains Down

Acquisition activity by private equity funds influence mergers and acquisitions (M&A) across many industries, but Q3-24 volume was down 64% from the peak. What does this mean for founder-owned and private companies who want to exit in 2025?

Corporate Credit Spreads Hit 20-year Lows - Is it Time to Refinance Your Debt?

With corporate credit spreads at their narrowest level in 20-years, now is the time for CFOs and corporate finance teams to consider refinancing debt, including their corporate credit facility.

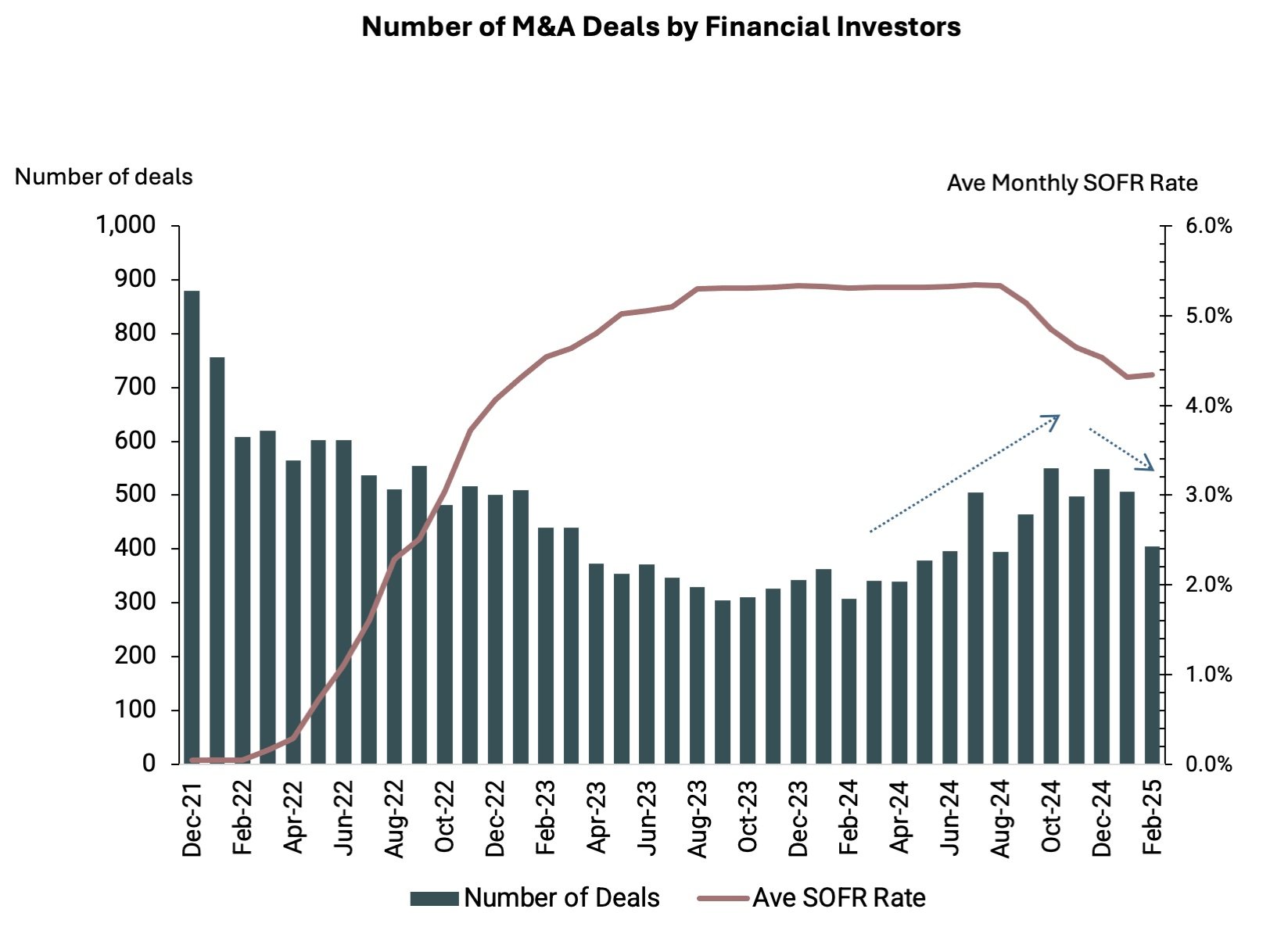

How Changing Interest Rates Influence Mergers & Acquisitions by Financial Investors

Financial investors like private equity funds and venture capital firms help shape the market dynamics of mergers and acquisitions (M&A) across many industries. But as interest rates have risen precipitously since 2022, there has been a significant decline in the M&A activity among financial investors. What should companies do who are looking for an exit?

Overview of Vital Farms’ Initial Public Offering

Overview of Vital Farms’ IPO: how a B Corp offering pasture raised products went from startup to the public markets. A look at private equity deal making amid COVID-19.